What’s the Lowest Possible Credit Score

Let’s get real: credit can feel like a mystery. But if you’re serious about building a strong financial future—whether it’s buying a home, launching a business, or securing funding—you need to understand the basics. And one big question that comes up a lot is:

“What’s the lowest credit score I can have?”

At Consult With Erika, we’re here to break it down in simple terms—and more importantly, show you how to turn things around if you’re struggling with low credit scores right now.

What Is the Lowest Possible Credit Score?

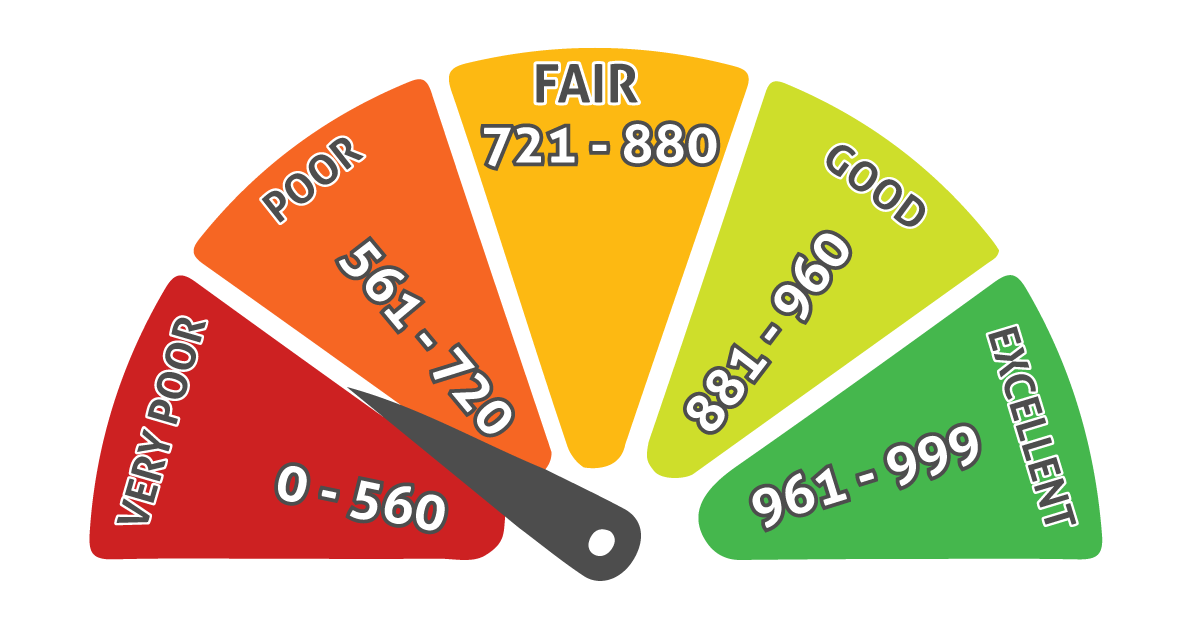

Credit scores typically fall between 300 and 850. The lowest possible credit score is 300—and while it’s rare to hit the absolute bottom, many people find themselves in the low 500s or even 400s after:

Missed payments

Collections

Defaults

Bankruptcy

Whether you're new to credit or recovering from setbacks, knowing your score and what’s hurting it is the first step toward change.

How Do Low Credit Scores Affect You?

Having a low credit score can feel like financial quicksand. It can:

Limit your access to credit cards, loans, and mortgages

Lead to higher interest rates

Affect your ability to rent a home

Even hurt your business funding opportunities

If you're an entrepreneur, low credit scores and business funding don’t mix well—so getting your credit in shape is essential for success.

Why You Might Have a Very Low Score

Here are a few common reasons:

No or limited credit history

High credit utilization

Late or missed payments

Defaulted accounts or bankruptcies

Identity theft or reporting errors

The good news? Your credit score isn’t fixed. With the right plan and support—like our credit repair and audit services—you can bounce back stronger than ever.

Steps to Recover From Low Credit Scores

Ready to make a comeback? Here’s where to start:

✅ 1. Check Your Credit Reports

Visit AnnualCreditReport.com and pull your reports from all three bureaus. Look for inaccuracies or negative marks that may be pulling you down.

✅ 2. Dispute Any Errors

Mistakes happen. If you see incorrect accounts, late payments, or fraudulent activity, dispute the errors right away. These can be removed and your score can improve fast.

✅ 3. Pay On Time, Every Time

Your payment history makes up 35% of your score. Set reminders, automate payments, and stay consistent to rebuild trust with creditors.

✅ 4. Lower Your Credit Utilization

Aim to keep your balances below 30%—ideally under 10%—of your available credit. Paying down high balances is one of the fastest ways to improve low credit scores.

✅ 5. Get Expert Help

We offer business financial consulting services that include customized credit strategies, so you can stop guessing and start growing.

Why Entrepreneurs Should Care About Credit Scores

If you're working on your brand, growing your side hustle, or building a business, strong credit can help you:

Qualify for small business funding solutions

Access business credit cards with better terms

Separate your personal and business finances

Build long-term wealth and freedom

Your personal credit is often the foundation for early-stage business growth. That’s why fixing low credit scores for entrepreneurs is a powerful move.

Final Thoughts

Your credit score is just a number—but it can either hold you back or open major doors. If you’re at the bottom right now, know that you’re not alone—and you’re not stuck. You just need the right roadmap.

📞 Ready to take the next step?

Book your free 15-minute strategy call today and let’s rebuild your credit—and your confidence.

👉 https://calendly.com/consultwitherika/15-min-strategy-call